How I changed my firm to command higher fees from clients with Erik Solbakken CPA - Pixie

Discover how Erik Solbakken CPA changed his accounting firm model to be able to work less whilst charging his clients more.

Welcome to our Expert Insights series. In this interview, we caught up with Erik Solbakken CPA to discuss how he changed his accounting firm's model to command higher fees from his clients (without going to battle with them).

Erik shared his version of 'hell' working as a partner in a traditional firm, as well as some insights around positioning and value pricing in his own firm.

You can watch the interview in full or read the transcript of the conversation below.

Welcome Erik. Do you mind giving us a very quick introduction to who you are and what you do?

Yeah. So I'm a Chartered Accountant; legacy Chartered Accountant, I should say, I know we call ourselves CPAs here in Canada as well. So I'm a CPA-CA and I used to be in public practice. For 18 years, I was in a traditional, shall we call it, multiple partner accounting firm, where we were grinding out the billable hour and going crazy, and then that partnership collapsed and then I went and started my own practice. And I did that for eight years, and during those eight years I tested and tried, like an entrepreneur, a bunch of different models, and I found something that worked that gave me incredible freedom. I made great money, worked with fantastic clients, and had a bunch of free time on my hands. That was about six years ago. Now I've sold my accounting practice quite easily for multiple and billings and then accountants started asking me how I did it. So I started working with them, wrote a book, and now I'm coaching accountants, showing them the accountant success formula; how to give freedom back to their lives.

What were the challenges that you were facing in your firm that really prompted you to discover a different way of doing things, and ultimately landed you where you are today?

So the first 18 years I was in a traditional firm, so I thought everything was normal. I thought this is... Tax time just had to suck. I had fallen under what I now coin the three lies, is that our clients are naturally price sensitive to our services, that my worth is equal to how many hours I work, and that tax time just had to suck. And so for the first 18 years of my life, I was into that mindset. And then when the partnership collapsed, I had a wake up call and I went, this is ridiculous. There's got to be a better way to do this.

Then for the next eight years, I had my own accounting practice and the breakup forced me to find a better way. So that's why I went in and I started testing and trying different methodologies. And so for the first 18 years of my career, I lived in what I had known as hell, and then in the second eight years of the career, to make it a total of 26, I found this solution that gave me this freedom. And it was basically out of pain and suffering that brought me to find this solution, and now I'm sharing it with accountants all over the globe.

And what were some of the biggest problems that you were facing?

So if you're in public practice, you'll understand what I'm getting to. Is that, you've got pressure from the partner, or you're pressured to get your billable hours in. So you're pressured to put in billable hours, but at the same time, keep your billable hours down so your clients don't complain about your bills. Then you do all this incredibly hard work, and then you give your clients a bill and then you expect them to just pay you quickly, and then they're price sensitive to that. And so there's this constant pressure. And then to build it on top of that, you're doing this crazy tax season. These hours we put in, I think there's a perverted misconception that our value as human beings, that our worth, is equal to how many hours we work, because the amount of hours we put in was ridiculous.

It seems like the more hours you put in the better. If you get around a bunch of accountants after tax season, you ask them, oh how was your season? "Oh, we were so busy. We worked 18 hours". The next one goes, "I worked 24", another one says, "I worked 27 hours a day". And you're like, where'd you get the extra three hours? He goes, "I'm really good". It seems to be what accountants think is normal, but it's not. You can actually work less than a normal workweek; I'm talking less than eight hours a day, and make incredible money, and have clients happy to pay you higher fees.

The problem is the model. It's not that accountants aren't smart enough. We are incredibly smart. We went to school for a long time. We have to stay up on all the tax rules. And so we're incredibly smart people but the problem is that the business model we're working under, the traditional accounting firm business model, is flawed.

So that's what I've found. Once you can fix the model and you get accountants working under a proper model, they flourish. And if there's anybody out there listening who understands the pain and suffering of going through tax season, and billable hours, and WIP and accounts receivable, they get it. They'll just be like bobble head; yeah, I understand Erik, you get it.

I know that you've got three steps to share around how to command higher prices. So should we jump straight in with the first one?

Yeah, let's do that. So again, just to come to a level set, why do we want to charge higher prices?

If you could take your accounting practice right now, any practice, and if you could double your prices from your clients, you could instantly make more money, but number two, you could offload a bunch of the low end work so you could end up working less, and inadvertently, which is strange, when clients pay you more money, they're less of a pain in the butt. They're easier to work with actually, when you charge more. So by increasing your prices, you get this trifecta that happens. You make more money, you work with great clients, and you get free time. So that's why it's so important. So what I wanted to do was just highlight the three keys to commanding higher prices, and not having to battle with your clients. Because the pain is always trying to charge clients more but then after the fact trying to justify your prices. That's a horrible model. That's where the conflict comes in with clients.

So the first point that I want to get to, these three keys, is I want to share... Number one is positioning.

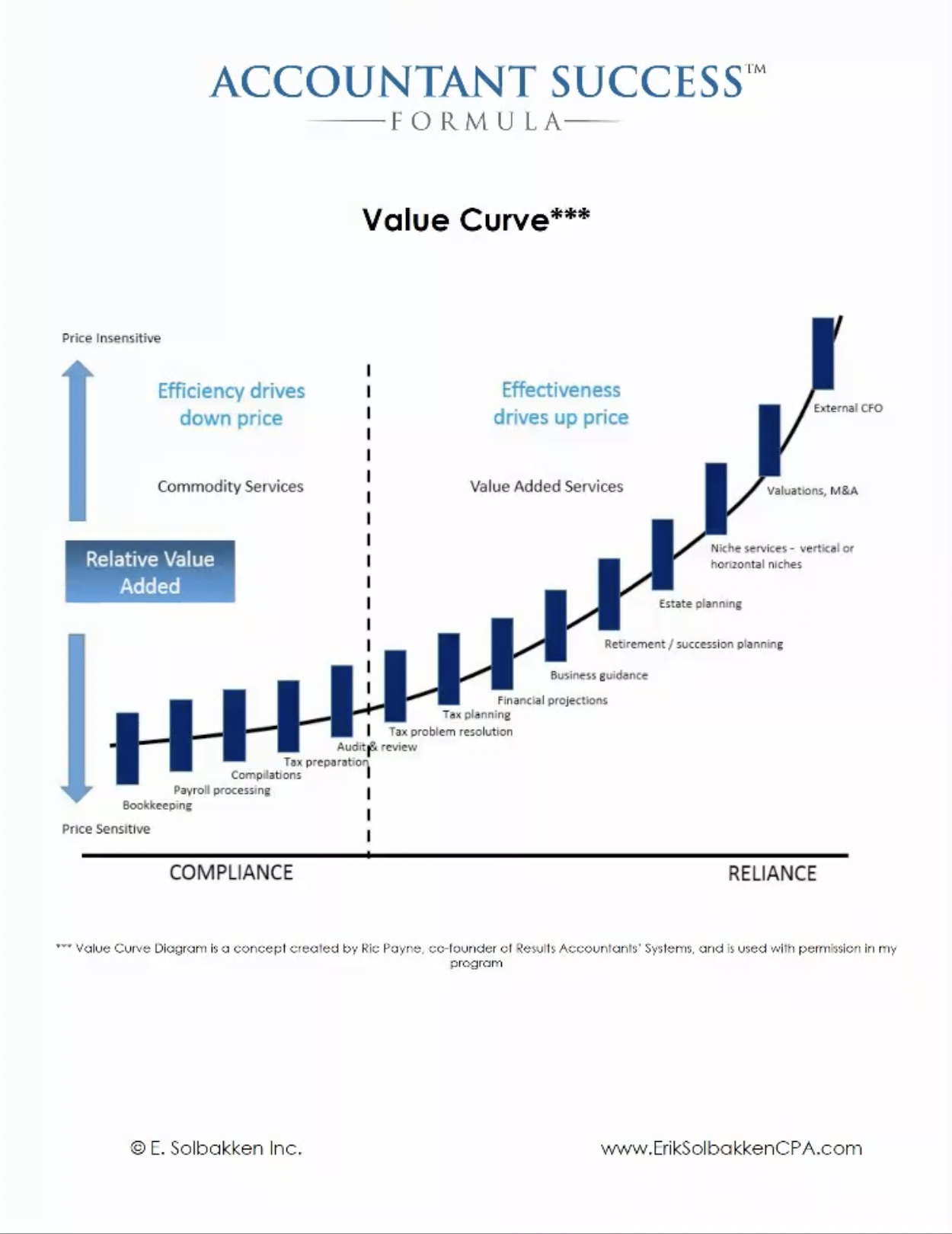

So positioning is all about where you're positioning your services along what's known the value curve. Now the value curve is something that I've found out from a fellow named Ric Payne. He was the Co-Founder of Results Accountants Systems, and he has given me permission to use this value curve because it is his IP. I've used it in my book, and in my courses, because it's such a foundational piece. But what it really shows us, is that what services and where you position yourself on the value curve affects how much you can charge.

So just from a simple perspective, if you're doing bookkeeping and payroll, along that bottom part of the curve, and compliance filings, you know that clients are incredibly price sensitive because those are just compliance. You have to do them. Clients just have to do these filings so it's the lowest value. As you move up the value curve, you can start to see that yeah, you can charge more and more as you go higher up the curve. Now, the interesting thing, is that when you get right to the top, the top value point isn't doing specialty tax work, and reorganisations, it's actually being a quarterback like a CFO-style person. That's a thing that business owners are really missing, is that professional looking, that oversight, the entire oversight. So that's the first thing that I want to just highlight there.

The other thing that's interesting, is there's a dotted line and it says here's the commodity services or the compliance ones, and then here's all the reliance services. What's really interesting is that the higher up the value curve you go, the less efficiencies are required. So in other words, people are willing to pay you more money as you go higher up the curve, but you're not focused on how can I get this done faster and quicker? Because the big... Especially today, what we have a lot of people doing, is trying to increase effectiveness or efficiencies; they're trying to go faster, faster, faster. So we've got software, we've got outsourcing. Everything's faster. Now, if you're working down at the bottom of the compliance curve or the value curve there, and you're increasing efficiencies, so you're getting faster and faster, what happens in a business model when things are produced faster and quicker? What happens to the price? Downward... It's a natural progression. If you can do it faster and quicker, then it pushes price down.

So what's really interesting is that it becomes a self-perpetuating issue. You are going faster and faster, but you're working at the bottom end of the curve. It puts even more downward pressure on your price. But if you get to the far right hand side of the curve, the external CFO, there's actually the price... Clients aren't price sensitive there. They're willing to pay more because the value they receive is so much greater. So it actually... You've got upward pressure on price. So when you see where you position yourself on the curve, you're either getting downward pressure on price, or upward pressure.

So what happens is the more effective you are as a deliverer, not how quickly you can deliver it; not quick, not speed, but effectiveness. If you're an effective CFO, which all professional accountants are they just haven't been shown how to, you'll have upward pressure on your price. So therefore this is the first basis of the three keys that I want to talk about, is number one is positioning. Where are you in the positioning of what services you're providing your clients, because where you're positioning yourself on the value curve is going to impact how much you can actually charge them.

Where can busy small firm owners find the time to make this transition?

So this is the interesting thing, is that we're so busy doing all the other stuff, the compliance stuff, that you don't have time to work on your business. It's that whole adage; you're working in it or on it, and most practitioners... And I did too because I was working in it, I was running and sprinting in place. The interesting thing is that when I show this to accountants and they look at it, it's not so much when am I going to have the time to do these extra services? No, you have the skills to do these already. You don't have to learn any new skills to be that quarterback, the CFO. And I can go deep into this, and in the accountant success formula, I show them how to approach this, because they're already trained. There's no extra things you need to learn. All you need to do is work inside the model where you're not having to do all that extra work to survive.

Because this is the problem; as soon as you can increase some prices, you get some pressure relief, you can offload a bunch of that lower-end work, and you can free yourself up to do the CFO work. So it's a chicken and an egg scenario. It's like, which comes first? You've got to do both. And so that's why I have a training program to show them how to split those two together, but they already have the training for the CFO.

Then here's the difference is that... And out in the market... And I'm not trying to put downward anything negative on any of these other advisors out there, but they've never worked in an accounting practice. They keep telling accountants how to do it, but they've never done it themselves. So the difference for me is that I actually lived this struggle of moving from the old model to a new model, and so that's why I created the accountant success formula, to give them a true path that has been not only... It's done by me, an actual accountant, and now I keep showing other accountants how to do it. So it gets proven over and over again, as opposed to being an outsider that says, well, this is what you should do in your accounting practice. And as you're an accountant, you're sitting there going, yeah that's fine, but I'm buried under all these tax returns. I get it. I understand that. And so that's why the accountant success formula was born, is for accountants showing accountants how to free themselves out of this model.

So that's the positioning part taken care of. The next part is all about having client conversations.

Yes. So key number is client conversations, and the client conversations... And this is what I've found in my practice, and again, I stumbled across this over testing and trying things, but I realised that what was happening is that the way we speak with our clients, the way we talk to them about what we do, creates a price sensitive client. We actually co-create, which is really painful. As opposed to in the spiritual world of being a co-creator, you're co-creating your own pain here, which is horrible to find out. But you co-create a price sensitive client by the way you talk to them about your services.

So here's an example. Client comes in the door, what do you need? The first conversation is, well how can I help you? Well, I need my tax insurance. Oh, great. I can do your tax returns. I can do your financial statements. I can do this. This is all the things I'll do, and I'll file this, and this, and this. I'll file this, and this, and this. And that's all I'll do for you. And that's pretty well where the conversation ends. And so what happens, is the client is focused on... You're focusing them on the stuff that you do, as opposed to the transformation they're going to receive as a result of what you're doing.

I have a PDF on my website, a really quick PDF, that goes into detail on this, but it's a concept of stuff versus transformation. So instead of having the conversation of all the stuff you do, the client comes in, I sit down. The first question I ask is okay, so what do you want? What's the biggest pain point that's happening right now? What's the thing you're trying to drive towards? What's the pleasure you're trying to get to? So we call it pain and pleasure. It's the transformation. So it's either, is it the pain of filing the tax returns? That's fine. That's low hanging fruit. That's easy. I'll take that away. You never have to worry about filing your stuff again ever; I've got it, we're done. Don't about it.

You can then focus on, and here's where the interesting part comes in, don't talk about doing all the tax returns, talk about the benefit. You'll now be able to focus on your business, to grow your business to XYZ, to be able to spend more time with your family doing this and that and the other thing; not doing this stuff. I'm taking this pain away from you, but I can't... We tend to focus on that. We focus on the stuff that we do, because we think it's so important, because again, our worth is equal to how many hours we work. We want to talk about all the stuff we're doing in that... We want to be able to charge them more by doing more. It's not about doing more for the client. It's about giving them more of the transformation. Does that make sense?

I think the transformation part that we're talking about here feeds really nicely into the third point, which is the billing model, and particularly value pricing?

Exactly. And so again, our three points is positioning, client conversations, and billing model. So let's go to the third one. In the billing model, again, we actually create price sensitive clients using our billing model, tying into the second point. Let's say I have the client conversation. I'm doing your tax return, your personal tax return, your corporate tax return, your PST, GST, HST, mama-T, all of these, and all the different acronyms we have. We try and we tell them all this stuff we have to do, and the client goes, "oh okay, well what's that going to cost?" And then we shift into our, well we charge by our standard billing rates by blah, blah, blah, and based on the complexity and all the time we spend... And instantly the client's thoughts go to, "I sure hope they don't take very long. I hope my stuff is simple."

And what we've done is we've transferred the client's focused attention off of the transformation that we're going to give them as a result of doing the work, to "oh my gosh I hope it doesn't cost very much." We've got them focused on the price instead of the transformation. And they're sitting there worried the whole time we're working, going, "I wonder how much this is going to cost? I wonder how much this is going to cost?" So we're co-creating a price sensitive client. The minute you do that, boom, they're price sensitive for life. Price sensitive because they're only going to be happy if and when the price comes in at a low number. And the other thing too, I see a lot of accountants going, well it'll be somewhere between $3,000 and $5,000, or it'll be somewhere between $300 and $500. Well, all you've done is given a client a range to say they're only going to be happy if the number comes in low. They're not going to be happy if the number comes in high, because now they're focused on the price. And so this is price sensitivity. So what I did in my accounting practice, and it was that after the fact, trying to bill clients that $5,000 or that $500 bill, and them getting upset about it, was too much for me. It was stressful, and I thought there's got to be a better way.

So I moved to a value pricing model, and value pricing has been used and been... Everybody's talking about value pricing. Well, that's fine. Why are you using value pricing? I used it because I wanted to get away from arguing with my clients about the price ahead of time. I wanted to set it up so that I knew the model I was going to build out for my practice, because I knew if I had X amount of clients at X price, I would have this much revenue, I would have this many staff to put to that, and I would have X amount of profit. It's a business model. So now I know clearly what I'm going to have.

And the third one, is I wanted to remove me chasing them for money, chasing them for fee. So what I did is I actually set up more of a subscription-based value pricing model with my accounting practice. And when I say subscription-based, it didn't mean that I was doing work for them every month Jordan. I had annual clients coming in, I did the financial statements, tax returns, some tax planning, and they came in once a year to see me. I still put them on this monthly subscription model, and the reason why the subscription model worked so well, is because it has four benefits. They knew the price ahead of time, it smoothed out their cashflow, I gave them unlimited access to call me when they had a question, and they could cancel it any time. Because of that, the clients were willing to pay me a higher premium. So I took a client from a previous, an existing client, from say $3,000 a year, to almost $5,000 to $6,000 a year, moving them to a monthly model saying, okay this will be about $500 a month. They were more than happy to do that because they knew the price ahead of time, it smoothed out their cash flow, I gave them unlimited access to call me whenever they had a question, and they could cancel at anytime.

So that created this... And once you have the conversation ahead of time, it forces you to actually talk about the transformation because you have to have the value high enough for the price that you're going to charge them. So the price and the value have to align. I used to say to my clients, and I share this with all my coaching clients, the accountants that I work with now, and I say, tell your clients when you're offering them the PSA, say if the price and the value don't align, then don't sign. Because it's all economics. If the price is here and the value is here, they shouldn't sign. But if the value is here and the price is here, then they do sign. And it's really simple. And so what it did is it got rid of all my accounts receivable, disappeared, my WIP disappeared and I stopped stressing about that, I had consistent cashflow, and clients were paying me more money. And so that's the final kicker here, is the billing model. So that's your three keys, is the positioning, client conversations, and billing model.

What does the action plan look like for somebody listening to this? What do they need to do first?

Well the first thing is being aware of the fact that you were in hell. See for me, I didn't even know I was in hell. I just thought it was normal, but it's not normal. There is an ability to actually have an accounting practice where you do zero overtime, and you make incredible money. Those first 18 years of my life, I was in a four partner multiple, a big firm. When I shifted over and started my own practice for those eight years, we never worked a single hour of overtime in those eight years, and I made triple what I made as a partner in the bigger firm. It's possible. So the first thing is knowing that it's possible, it's your choice.

Second thing is then looking into it and reading a bit more about it. So I have a free book, free plus shipping offer for my book, on my website. I also have some free PDFs that are available right there, all you do is plug in your email address and I'll give you those. I have a free masterclass where I actually go into deeper detail. But I go into deeper dive into the actual model of how you shift between the two. And then at the end of that, I also do coaching. So these are all things to give your readers and listeners an ability to look and say, I'm ready for this. Well there's a book, there's a PDF, there's a masterclass that I have, and then if they're ready and willing and they want to work with me, then I work one-on-one with accountants as well. I've got an online course and I do one-on-one coaching, but that's for them to decide down the road, but it's the decision they need to make first.

But here's the thing, is I've been down the road before, and that's why I call the accountant success formula the path to freedom, because it's the three freedoms that every accountant deserves. They deserve to make great money, they deserve to work with clients who appreciate them, and they deserve free time. And those are the three freedoms; money, clients, and time. That's why I created the accountant success formula. So they can find that on my website, and like I said, that would be the next step that I would say for them.

About the author

Celso Pinto

A Portuguese expat in London, Celso founded Pixie after learning first-hand about the challenges faced by small accountancy and bookkeeping practices. A product-focused leader with over 20 years experience in the software industry, at Pixie you'll frequently find him listening to customers and distilling their feedback into the product and go-to-market strategy.