Use fixed date deadines in your Pixie workflows - Pixie

As accountants, you're used to working to external deadlines. Lots of these depend on the client e.g. accounts filing deadline and corporation tax deadline

Lots of these depend on the client e.g. accounts filing deadline and corporation tax deadline.

But some deadlines are fixed dates e.g. the 31st January tax deadline in the UK, or the 15th April income tax return deadline in the USA.

Which is why we've introduced fixed date deadlines into workflows in Pixie.

Now, you have the ability to set your task creation date (e.g. 6th April for Personal Tax workflows) and a fixed deadline date (e.g. 31st Jan for the same workflow).

This means that instead of working up to a date e.g. 9 months after task creation, you can work to a very specific date.

Another great use case for this is when setting internal deadlines within your firm.

If you wanted to have some internal deadlines and milestones for your workflows based on days or months before the fixed deadline, you can do.

These internal deadlines help you to manage the different job stages and ensure things like personal tax returns are being worked on throughout the year.

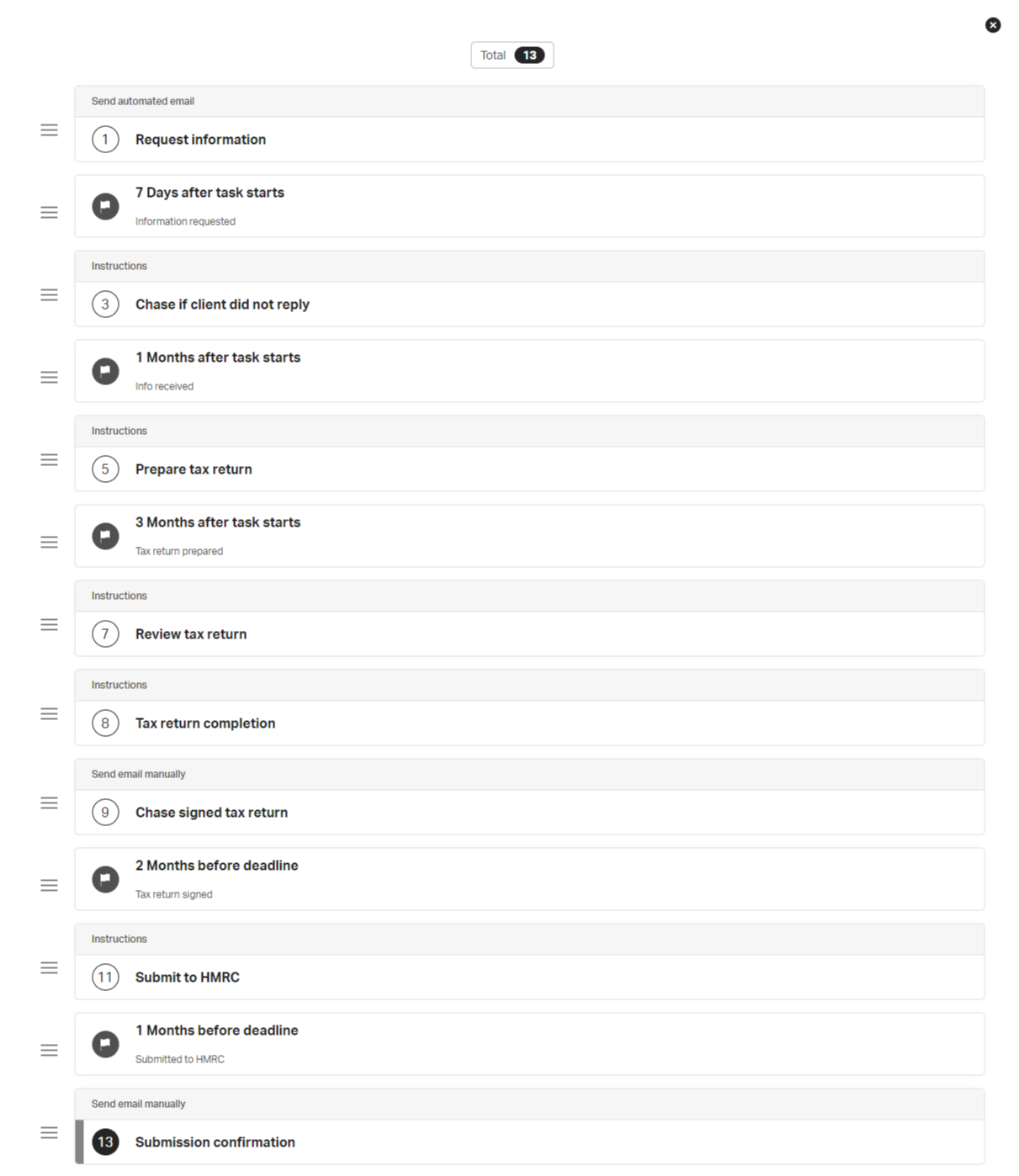

Here's an example of how they would work in a Personal Tax workflow in Pixie using a mixture of deadlines after the task has started and deadlines before the task is due.

If you have any questions about using fixed deadlines within your Pixie workflows, please contact us using the in-app support or by using the chat box in the bottom right corner of this page.

About the author

Celso Pinto

A Portuguese expat in London, Celso founded Pixie after learning first-hand about the challenges faced by small accountancy and bookkeeping practices. A product-focused leader with over 20 years experience in the software industry, at Pixie you'll frequently find him listening to customers and distilling their feedback into the product and go-to-market strategy.

-3.png?height=248&name=62556f20440d0b8474aac422_Website%20Images%20Updated%20(18)-3.png)

-3.png?height=248&name=60815ff743bec3cf624f82f2_accounting%20workflow%20software%20(1)-3.png)